-

Savvy Strategies to Pay the College Bill

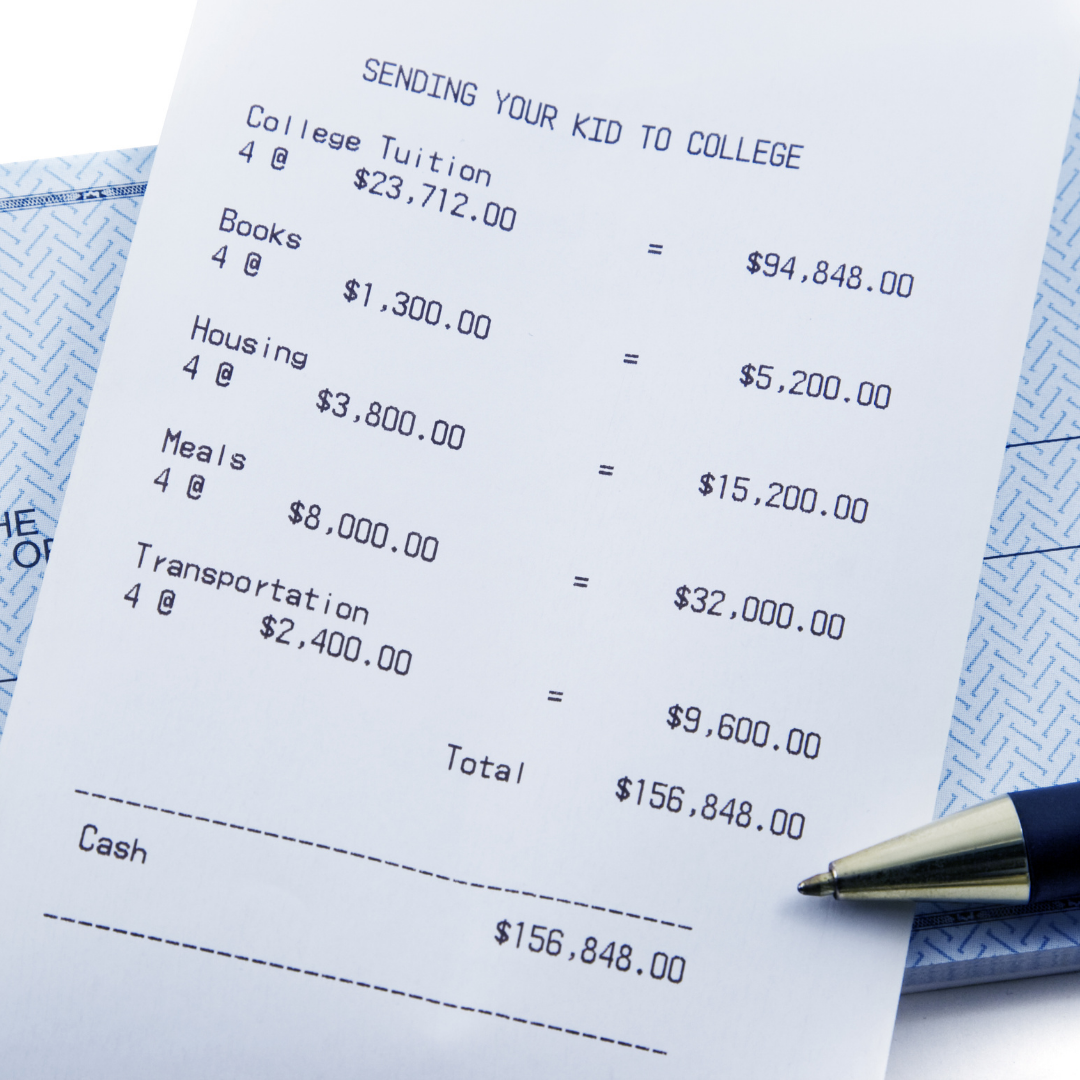

Is your family anticipating a college bill, but a little uncertain about how much you actually will owe or exactly how you will pay?

-

Do you want free money for college?

Who doesn’t want free money for college? Some canny students have paid their full college bill using third-party grants and scholarships. The more you find, the less student loan debt you are likely to take.

-

How Grandparents Can Help Save for College

Many grandparents want to help their grandchildren achieve their dreams of college. Unfortunately, how grandparents save or offer assistance can unintentionally reduce a student’s eligibility for financial aid. Knowing some of the rules in advance will ensure that a grandparent’s good intentions are fulfilled without penalizing the student. If you are a grandparent (or soon

-

How to Increase College Savings without Leaving Your Couch

Use these holiday hints to increase college savings and by this time next year, you’ll be proud of your accomplishments. (…and don’t forget to clue in grandparents and other relatives to get a bigger bang for your buck!)

-

Why is the cost of college different for every student?

When people buy things, they know the price and act accordingly. For inexpensive stuff, Apple-pay, a debit card or cash is offered without much analysis. With increasingly more expensive items, such as a TV, a car, or a house, consumers research. They consider options and shop around to determine what is affordable and how to

-

Student Loan Basics: The Difference between Consolidating and Refinancing

Picking a student loan that meets your needs requires an understanding of some basic concepts. Student Loan Basics empowers you with information to make informed choices to borrow for college and manage the debt after college. This article explains the important differences between consolidating and refinancing student loans.

-

Student Loan Basics: How to Pay-off your Loan Faster

Picking a student loan that meets your needs requires an understanding of some basic concepts. Student Loan Basics empowers you with information to make informed choices to borrow for college. This article explains loan amortization and shows how to pay off student loans faster.

-

Student Loan Basics: Fixed & Variable Interest Rates

Picking a student loan that best meets your needs requires you to understand some basic concepts. Student Loan Basics is a series of articles to empower you with information about student loans and help you make smart financial choices.

-

Save Money: Dig into Financial Aid

College admissions decisions are arriving – a joyous time for students relishing their success. A disappointing moment when dream schools say no. No matter which, these emotions will soon be overrun by the reality of making a school choice. And then figuring out how to pay the coming college bill. Lurking under it all: how much student loan debt will