College admissions decisions are arriving – a joyous time for students relishing their success. A disappointing moment when dream schools say no. No matter which, these emotions will soon be overrun by the reality of making a school choice. And then figuring out how to pay the coming college bill. Lurking under it all: how much student loan debt will be required to get to graduation?

The good news: for the first time in the college admissions process, families are in the driver’s seat. Finally, they are the decision-makers. The best-informed will consider affordability as a primary consideration. Between now and May 1st, families will receive all the information they need from the colleges, including the financial aid award letters. Now comes the task of selecting the best financial, academic and social fit.

Understanding the components of a financial aid award letter will help many families begin the process of evaluating financial fit.

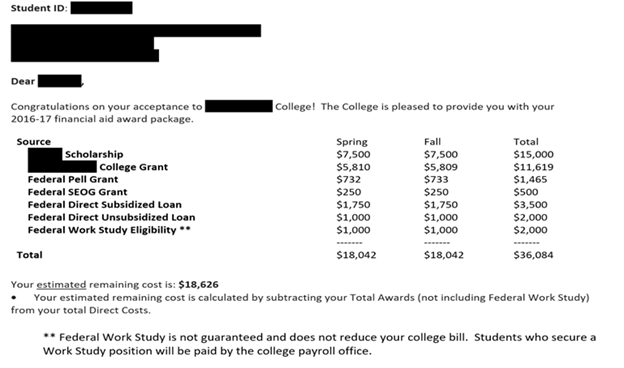

Here’s a sample Financial Aid Award Letter:

This financial aid award letter looks terrific – more than $36,000 in financial aid. But is this school affordable? Maybe, yes. Maybe, no.

Here’s how to tell:

Step 1: Look for the free-money

Grants and scholarships do not have to be repaid. The letter above shows these in items 1-4. The federal government, states, and colleges offer need-based grants to students with the greatest need. Scholarships are often merit, not income, based awards offered for some exceptional talent or uniqueness that the student will contribute to the college community. Free money is great, but be sure to know the fine print: are these one-time awards? Are there any strings attached? Is the student required to do something to maintain the award for the next three years?

Step 2: Understand Federal Work-Study

Federal Work-Study award above purposely says “eligibility.” Federal Work-Study does not reduce the amount that a family pays when the college bill is due. It is an offer of a guaranteed job. In this case, for up to $1,000 per semester. The student will pay the full college bill when it is due but will have the opportunity to earn $2,000 over two semesters. The student does not have to accept the Work-Study award. In fact, some are able to find a higher paying part-time job without a cap. Others, may find a more appropriate job offering direct experience in their field of interest.

Step 3: Know that Loans need to be Repaid

Loans are “awarded,” but they will need to be repaid. First-year students may borrow up to $5,500 from the federal government. Second-year students may borrow up to $6,500 and upperclassmen $7,500 per year. In the example above, the school packaged both a Subsidized Federal Direct Loan and an Unsubsidized Federal Direct Loan. While in school, the student will have the choice to either pay the monthly interest on the Unsubsidized Direct Loan or allow it to capitalize. Capitalized interest is the amount of interest that is due but unpaid each month. The principal amount of the loan increases each month by the amount of capitalized interest. To minimize student loan debt, borrowers should try to pay the interest on Unsubsidized Direct Loans while in school.

Subsidized Direct Loans are offered to students from lower-income families. The government pays the interest on the loans while the student is in school. Therefore, there is no capitalized interest. The amount initially borrowed does not increase while a student is studying.

Step 4: Is there any unmet need?

Finally, look carefully to find the “unmet need” – the amount owed after taking financial aid into account. This is the amount of tuition, room and board, and mandatory fees not covered by the financial aid package. Here, unmet need is labeled “Your estimated remaining cost” totaling $18,626. After taking $5,500 of student loans and assuming $2,000 of Work-Study earnings, the student still needs to come up with over $18,000 for the unmet need. Other expenses such as books, travel expenses and pocket money to get through freshman year will also be incurred. In this example, the total out-of-pocket cost to the family for freshman year is likely to exceed $20,000. So, is this college affordable for the family?

Step 5: Determine if this College is Affordable

Maybe. If the family has the means to raise approximately $20,000 from some combination of:

- Savings

- Current income from parents applied perhaps to a Tuition Payment Plan

- More loans such as the Federal Plus Loan or private credit loans

If the family does not have access to savings, current income or additional loans, this school is not affordable.

Step 6: Consider all Four Years

Above, we consider the financing picture for one year. It is highly likely that the family would have to have more than $80,000 of additional funding to get to graduation. This example shows how quickly college debt can become an albatross.

Moving from the joy of receiving acceptance to the reality of paying the college bill can be sobering. Sometimes a student’s best option is to choose a lower-cost school, start at a community college and transfer, or take a gap year to earn more money to make a dream school affordable. Although these choices can be emotionally difficult, realistically considering affordability before sending a check to secure a spot in the freshman class could result in a family avoiding a lifetime of regret for borrowing excessively for college.

Digging into financial aid award letters will help identify the colleges which best fit financially and will help families avoid excessive borrowing to achieve their children’s dream of college.