“Sometime in December”

Hard to believe, but that is the U.S. Department of Education’s official response when asked for the date that this year’s FAFSA will be available. The Free Application for Federal Student Aid (“FAFSA”) is delayed this year because the U.S. Department of Education (“ED”) is simplifying the form and changing the output to the new Student Aid Index (“SAI”).

Why is this delay a big deal? Right now, current college freshmen, sophomores, and juniors as well as high school seniors have no way of officially knowing their eligibility for federal financial aid for academic year 2024-2025. Additionally, those current high school seniors intending to apply Early Decision or Early Action will have no idea how much need-based aid they might get before they apply.

In effect, high school seniors are being asked to file applications to colleges with $60,000+/year sticker prices before they might know how much the price will be discounted by financial aid. That’s not much different from permitting your 18-year-old to go to a car dealer of their choice with the instruction to pay the sticker price without negotiating or asking for a financing package.

Having stated the reality for this year’s students, let’s focus on what we know and what you can do. If you want to know what you can do NOW to be ready to file the FAFSA “Sometime in December,” skip The Back Story.

The Back Story

Created in 1992, the Free Application for Federal Student Aid (“FAFSA”) is the most important financial aid form a student submits. It is required to be eligible for Federal Pell and SEOG grants, Federal Direct Student Loans and Federal Work Study awards.

In 2016, the date the form became available was moved from January 1 of the year in which federal aid was sought to the prior October 1. For example, for academic year 2016-2017, the form would have been available on January 1, 2016, but for Academic Year 2017-2018, the form first became available on October 1, 2016. These extra few months gave families an opportunity to know the student’s eligibility for federal student aid before they applied to college. Colleges liked this change too because it gave them more time to process financial aid awards.

Other changes were made in 2016 intended to reduce confusion and simplify the process:

- The FAFSA required information from the student and parent tax returns from the “prior-prior” year, a weird term that simply means two years before the academic year that the student is requesting aid. You can remember this by subtracting two from the academic year. Today’s high school seniors requesting aid for Academic Year 2024 would need tax return info from 2022 (2024 – 2 = 2022).

- The ED offered FAFSA filers the option of using the Data Retrieval Tool, which automatically uploads a filer’s prior-prior year tax return data onto the FAFSA. The goal was to reduce errors that occurred from manually inputting data.

The End of the Back Story

In 2021, the U.S. Congress passed a law requiring that the FAFSA be simplified. The result of that effort will be official “Sometime in December” when the FAFSA is made available for Academic Year 2024.

Here’s what to expect:

- The number of questions on the FAFSA will be reduced from about 108 to less than 50.

- The Student Aid Index (“SAI”) replaces the Expected Family Contribution (“EFC”). For more on that important development see MyCollegeCorner.com’s blog post “The Student Aid Index: The New Way to Calculate College Aid.”

- The IRS Data Retrieval Tool has been replaced by the IRS Direct Data Exchange. FAFSA applicants will be required to provide consent for the ED to receive tax information directly through the IRS Direct Data Exchange.

- The FAFSA Submission Summary replaces the Student Aid Report.

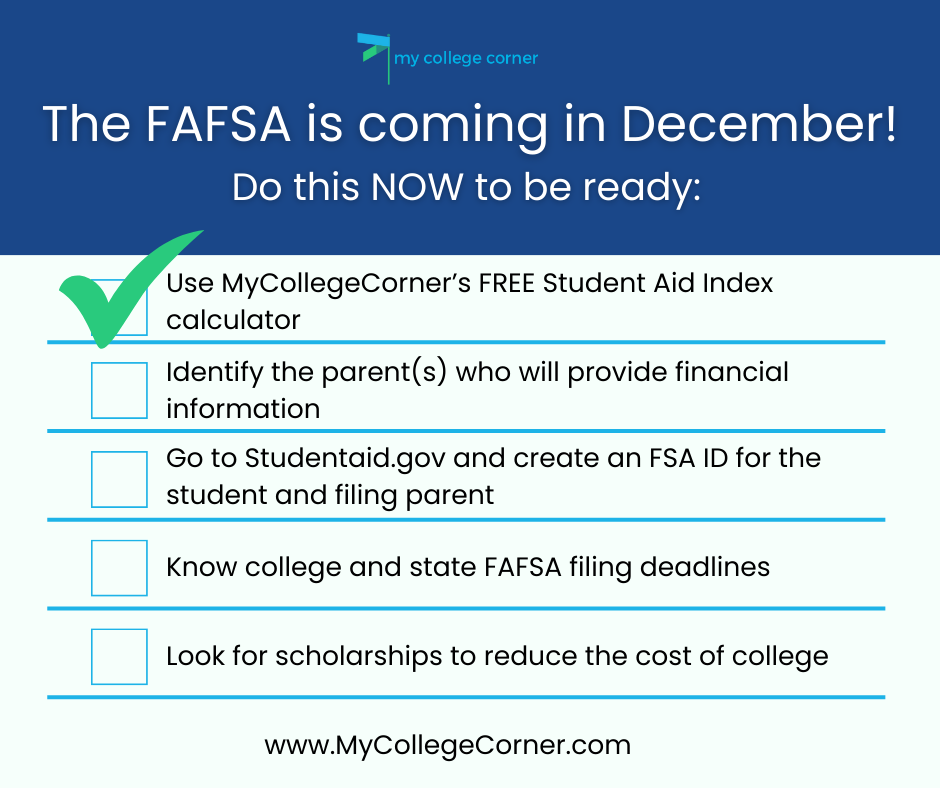

5 things you can do NOW to be ready to File the FAFSA “Sometime in December”

- Use MyCollegeCorner’s Free Student Aid Index Calculator. Based on the information provided by the U.S Department of Education about its formulas to be used in the SAI, the calculator asks for a minimal number of inputs that should take about 5 minutes to complete and you’ll get an estimate of your student’s SAI.

- Identify the parent(s) who will provide financial information. The FAFSA requires income and asset information for the student and parents. For separated or divorced parents, the parent who provided the most financial support for the child in the prior year is the one who needs to provide the prior-prior year tax information.

- Go to Studentaid.gov and create an FSA ID for the student and filing parent. This ID will be used by the student and parent for a variety of uses and will not change. No sense waiting. Create it now.

- Know the college and state FAFSA filing deadlines. States and colleges have different deadlines to file the FAFSA form. Check your state’s FAFSA filing deadline and the filing deadline for each college to which your student plans to send an application. These deadlines are often inflexible so do this ASAP.

- Look for scholarships to reduce the cost of college. Free money is good money, and there is plenty out there. Try this free Scholarship Search at MyCollegeCorner.com

The Last Word

The process of planning and paying for college is stressful enough for families without the added pressure of a delayed FAFSA form. But there are some things you can do to be better prepared. The five tips presented above will help you when it’s time to file the FAFSA “Sometime in December.”