Based on the Department of Education’s 2025–2026 Pell Eligibility and Student Aid Index Guide.

Our financial aid experts have created a free Student Aid Index calculator to help you estimate how much your family will pay for college. It’s easy to use, and can be completed in under 5 minutes! In order to use the calculator, you’ll need information from your 2023 tax return. Don’t worry—we tell you exactly which lines to use or you can just put in an estimate to get started. You will immediately receive your free estimate. You’ll also receive a downloadable report to help you understand your SAI or student aid index and answer questions you may have.

Important FAFSA Changes

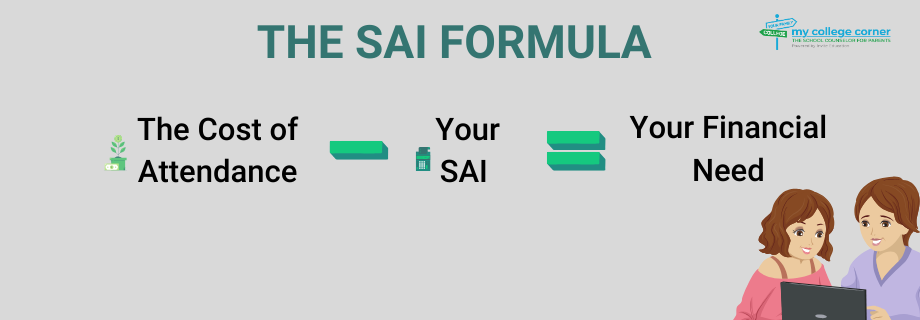

All students who want financial aid for college in the 2025-26 academic year must complete the FAFSA (Free Application for Federal Student Aid). The Student Aid Index (SAI) is an estimated indication of how much you may be able to pay for college based on your income and assets. It is not the absolute amount of money you will have to pay because a college is not obligated to offer you financial aid or it may offer you more aid than your SAI indicates. It is an indication of your eligibility for financial aid.

While this is applicable to new college students, the SAI will also be used for returning college students. All students who want any financial aid need to complete the FAFSA. It is a good idea for students with the means to pay for college without financial aid to also complete the FAFSA so they have the option to borrow student loans from the Direct Student Loan Program if they want. Completing the FAFSA is necessary whether students plan to attend a 2-year or 4-year (public or private) institution.

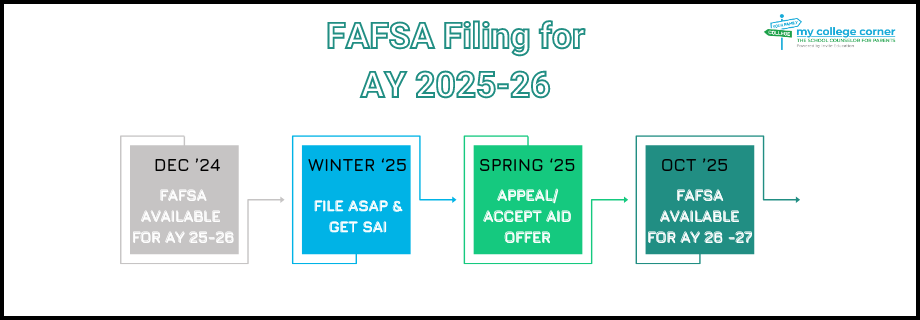

The 2025-26 FAFSA application will be available sometime in December of this year. But you can use this SAI calculator now to get an estimate of your “official” SAI after you file your FAFSA.

To get ready to file your FAFSA when it is available, students who don’t have one should get an FSA ID. Families should have their 2023 tax forms complete and correct for parents and students if applicable.

It’s important to understand your SAI is the estimated amount that you will be expected to pay based on the total cost of attendance. Knowing what your student can expect in the form of financial aid can help your family make better choices and make the college application process less stressful for you and your student.

Read more and subscribe to our blog to stay up to date on the latest college financial aid news.