Is your family anticipating a college bill, but a little uncertain about how much you actually will owe or exactly how you will pay?

You are not alone.

For too many families, the joy of being accepted and picking a college is quickly replaced with the dread of paying the bill.

We’ll help you create a strategy and plan to pay that makes sense for your family.

What are the best sources of money to pay for college?

If you are reading this article, you most likely cannot simply write a check to pay the full bill or did not get a free ride from the college. Like so many others, you’re asking: what should I do?

Most families will chip away at the college bill using a combination of the following sources:

- Financial Aid from the college, state and/or federal government

- Scholarships

- Grants

- Work-study

- Federal student loans

- Family Contributions

- Parent and student savings

- Gifts from friends and family

- Private Scholarships

- Income that will be earned by the student and/or parents during the school year

- Tuition Payment Plans

- Other loans for parents and students

- Parent PLUS loans from the federal government

- Private student/parent loans from banks, credit unions, credit card companies, specialty finance companies, state agencies, and sometimes colleges themselves.

This article discusses each source of money for college and provides tips and resources to help you understand how to utilize them.

Loans are at the bottom of the list purposely. Student loans should be the last resort, and not the first option when paying for college.

For most families, the question of how to pay the bill starts with knowing how much they will owe after receiving financial aid.

The Financial Aid Award Letter

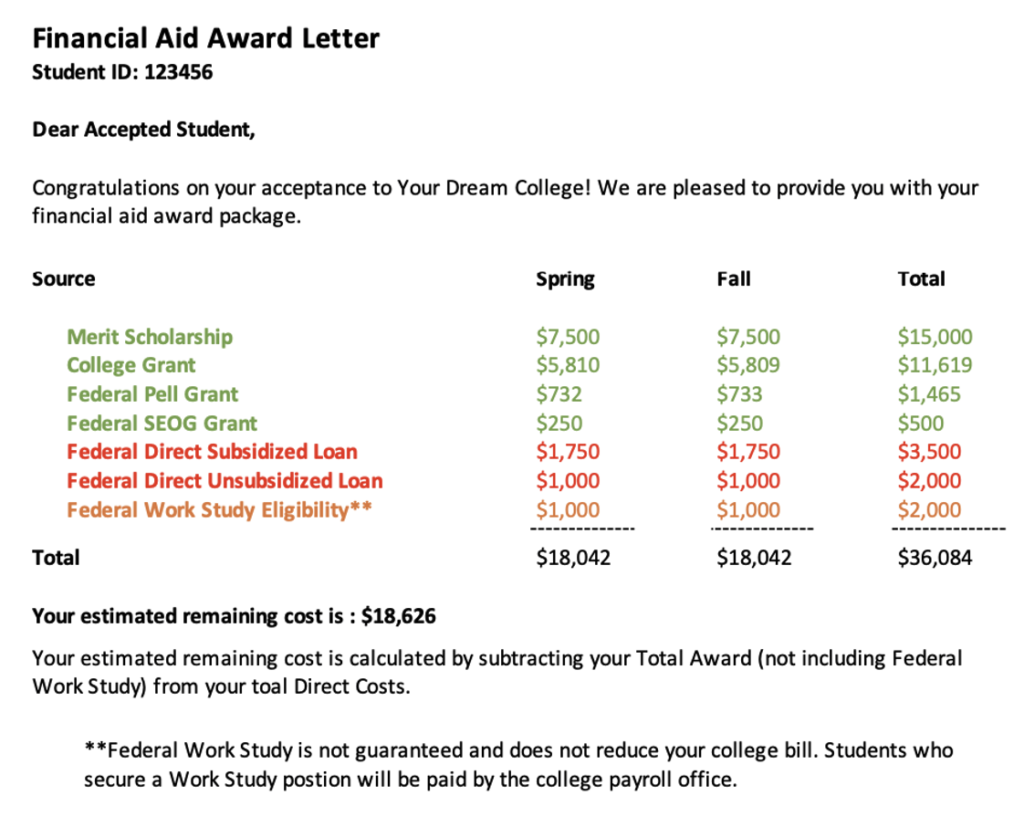

Students find out how much financial aid they will receive (i.e., their “package”) in a financial aid award letter. Understanding what the award letter says can be a challenge. Despite attempts to standardize the format to make it easier to compare one award to another, most colleges use their own format. The good news is that no matter the format, award letters communicate the same three different types of awards:

- Free Money: grants and scholarships based on need or merit (green below)

- Earned Aid: eligibility for a federal work-study job (orange below)

- Loans from the federal government – and sometimes the college (red below)

In the sample award letter below, notice:

- Total aid of $36,084 includes:

- $5,500 of loans: the maximum a first-year student can borrow from the federal government. Although this loan is characterized as “aid” on the Financial Aid Award Letter, it must be repaid. For more on federal student loans visit Federal Student Aid.

- Eligibility to earn up to $2,000 from the federal work-study program. Work-study does not reduce the college bill but is a job offer making it easier for the student to count on income during the school year.

- The family needs to pay $18,626 (the “gap”) after receiving the aid.

- This Award Letter is for one year. Students must reapply for aid each year for the next academic year.

Families who have experienced financial difficulties in the recent past may appeal for more financial aid. This article discusses how to appeal a financial aid award.

With the financial aid package known, families now have 3 big questions to address:

- Can the student/family pay this bill?

- How: what funding sources will the family use?

- Is this college affordable for the student without a massive amount of loans?

Resource

If you are reading this in preparation for your turn in the financial aid process, use this Financial Aid Calculator to estimate your student’s current eligibility for financial aid.

Family Contributions

Family contributions include student and parent savings, and gifts from family and friends over the years or maybe from high school graduation. The most important realization is that you have to be realistic about the amount of gift and savings money available. There is no benefit to wishing the amount was more or beating yourself up that you didn’t save enough over the years. You have what you have and it’s going to be helpful no matter how much is saved.

According to Strategic Insight, on March 31, 2021, 14.1 million 529 college savings accounts held assets of $412 billion. The average account balance of a little over $29,000 is a nice nest egg, but barely covers the cost of one year of tuition at the average four-year college.1

For our example, let’s assume the student has $29,000 in savings. There is no correct answer on how to allocate savings from year to year, so we assume 25% of this total is used each year.

For this student, the family contribution totals $7,626:

- $7,250 from savings

- $376 from graduation gifts

The gap to be filled is now $11,000.

Resources

Use this College Savings Estimator to see how much you will have saved by the time your child reaches college. It is never too early or too late to begin saving for college. Saving even small amounts for high school juniors and seniors can be helpful. With college graduation four to six years away, those savings could result in less student loan debt. Saving a dollar today is better than borrowing one tomorrow®.

If you have younger children, use this Cost of Delaying Savings Calculator to see the power of starting a college savings program for younger children.

Private Scholarships

Private scholarships are offered by employers, individuals, charitable organizations, foundations, and many others. Think of these providers as just about any organization other than the school or government.

Most private scholarship providers require students to apply for their award. Often, the application includes an essay, personal statement/resume or something related to the nature of the scholarship. Some run contests or make selections from art or other submissions.

For our example, let’s assume that the student won a private scholarship of $5,000 leaving a gap of $6,000 to fill.

Resource

This Scholarship Search will help your student find a scholarship based on their talents and interests. The “Success Rate” indicator sorts the scholarships based on previous applicants’ success rates. For instance, a 75% Success Rate means that 75% of the applicants were awarded a scholarship by that provider.2

If your student is not yet a senior, think about what steps they can take now to finance their college education later. In addition to entering contests, early high school students should consider how they can best position themselves for scholarships and other monetary awards granted during senior year. For some scholarships, they may need to file an application or obtain letters of recommendation. Planning this in advance reduces the stress later in the process.

College students also have opportunities to continue competing for scholarships and prizes. Just as with savings, winning a dollar today will reduce borrowing tomorrow.

Income

Using income from both the student working part-time and the parents while a student is in college can be a smart way to minimize borrowing.

Let’s assume that the student and parents will be able to contribute from their current income:

- The student accepts the $2,000 work-study award

- The parents are able to contribute $2,500 ($250 per month for each of 10 months that the student is in school).

The gap of $6,000 has been narrowed to $1,500.

Most colleges offer a Tuition Payment Plan through a company specializing in these plans. Families identify how much of the college bill they want to pay using a Tuition Payment Plan. Usually for a one-time fee, the company pays the college that amount and then bills the family each month over a period of up to 10 months. For our example, we assume the student and parents will contribute $4,500 in income. Using a Tuition Payment Plan, they will pay $450 per month for 10 months.

Tuition Payment Plans offer families an opportunity to use future, but near-term current income, to pay the current college bill without increasing student loan debt. In our example, if the family did not use the payment plan, they may have taken an additional $4,500 in loans or decided that the college was unaffordable.

Loans – the last resort

This family now has a gap of $1,500 to fill after it:

- Accepted the financial aid package, including $5,500 of government student loans and a $2,000 work-study award

- Found a $5,000 private scholarship and

- Paid $4,500 using a Tuition Payment Plan

The family now has two options:

- Decide that the college is not affordable and find a less costly option – perhaps an in-state college or one that is offering more financial aid.

- Borrow $1,500 from the federal PLUS program or a private lender

There are pros and cons for both the federal PLUS program and private credit loans obtained from banks, credit unions, finance companies, state agencies and others. This article offers tips on choosing between federal and private loans.

PLUS Loans

The federal government’s Plus Loan Program permits parents to borrow up to the full amount of their unmet need with a minimal credit test of “no adverse credit.” The current interest rate is 5.30%, with an origination fee of 4.228%. The parent is the sole borrower and does not have the option to transfer the loan to the student in the future.

The PLUS loan interest rate is a fixed rate that is set annually and is used for all PLUS loans made in the applicable academic year. The new PLUS loan interest rate for Academic Year 2021-22 will be announced shortly and will take effect on July 1, 2021 and be used for all PLUS loans made until June 30, 2022.

Private Credit Loans

Private credit student loans are made by banks and others based on credit criteria they establish. Unlike the PLUS loan program, which has a low bar for getting the loan, private lenders require borrowers to have a good credit score and a demonstrated capacity to repay the loan. The interest rate is usually based on the parent’s credit profile, those with a stronger credit rating will be offered lower interest rates. Unlike the PLUS loan program, private lenders do not typically charge an origination fee.

When taking a private student loan, the student is often the borrower and the parent is the cosigner. In effect, the cosigner lends their good credit rating to the student, so they can obtain the loan. Many private lenders permit the cosigner to be dropped from the loan using a feature known as the cosigner release. Cosigners may be released after a certain number of on-time payments are made, and the student contacts the loan servicer to obtain the release.

Generally, parents with very good to excellent credit histories will be offered loans without fees and interest rates lower than the federal PLUS program. These parents trade-off more flexible repayment terms offered by the federal government for a potentially lower interest rate and no fees.

Resources

Use this Student Loan Repayment Calculator to estimate monthly loan payments and see if the loan is affordable.

MyCollegeCorner.com also offers free webinars and blog articles further explaining many of the topics discussed in this article.

A Last Word

Finding an affordable college may require some very difficult choices. In the example above, without the $5,000 scholarship, the amount of the gap would have ballooned to $6,500 after financial aid, savings and gifts, and using income. If the first-year gap was $6,500, the cost of college did not increase and the aid package remained the same, this family would have to borrow $26,000 in addition to the student’s loans. Total borrowing could easily have exceeded $50,000 by the time this student walked across the stage for graduation – potentially making this college unaffordable for the family.

Paying the college bill requires families to be realistic about their financial situation and to choose from the options that make the most sense for their circumstances. Understanding financial aid, winning third-party scholarships, and using student and parent income can help reduce the amount of loans needed and to help families achieve their dream of college.

__

® -Registered trademark, Invite Education, LLC

1 – According to the College Board, the average cost of tuition at a private, 4-year college or university is $32,410. The average cost of a public college or university is $23,890 for out-of-state students and $9,410 for in-state students. In-state prices can be substantially higher or lower based on the location of the school. The total cost of attendance can be substantially higher after adding room and board and other expenses to tuition.

2 – Based on data provided by the scholarship provider. Not all data is for the previous academic year.