This free Student Aid Index (SAI) calculator estimates eligibility for need-based federal financial aid which could include Pell Grants, Work-study and Direct Student Loans. In less than five minutes you will have a downloadable report.

The SAI is used by all two-year and four-year, public and private colleges to award need-based aid. States and others also use the SAI to provide financial aid.

The U.S. Department of Education calculates a student’s “official” eligibility for aid when a student completes the Free Application for Federal Student Aid, the FAFSA® form. The FAFSA® for Academic Year 2026-27 is available beginning October 1, 2025.

This calculator:

- Estimates the key number in the financial aid process: the SAI

- Directs you to the required tax line items from the 2024 tax returns

- Allows you to use estimates if you don’t have tax filings handy

- Shows the effect of parent and student income and assets on aid eligibility

- Offers information about how colleges use the SAI

- Answers FAQs

- Generates a downloadable PDF report

- Does NOT save the information you provide

Why FAFSA® is Important

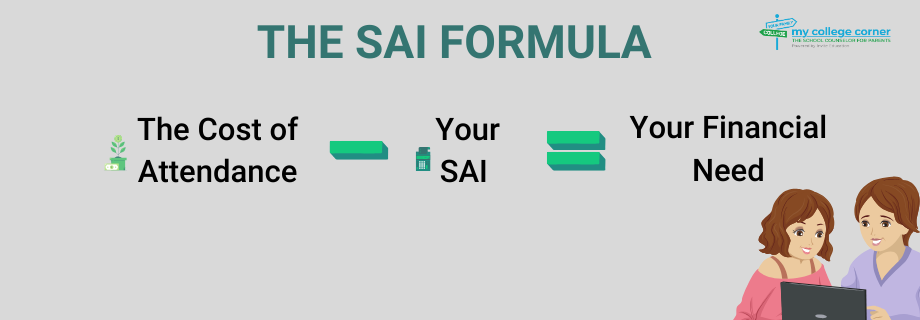

All students who want financial aid in Academic Year 2026-27 must complete the FAFSA® by the deadline required by the college. The Student Aid Index is an estimate of eligibility for financial aid, not the amount of money you will have to pay for college. Colleges are not required to offer a student any financial aid, or they may offer more aid than the SAI indicates.

What’s required to file the FAFSA®

Students and Contributors need an FSA ID to file the FAFSA® and use information from their 2024 tax returns and current values for assets such as college savings accounts. An FSA ID is unique to each filer and can be used from year to year and for different students for which you are a Contributor. The FAFSA® has an automatic tax return upload feature for students and parents. Asset information should come from current statements.

Students who are applying, or returning, to college next year (AY 2026-27) need to file the FAFSA® before college’s deadline. Students with the means to pay for college without financial aid may also wish to complete the FAFSA® so they have the option to borrow student loans from the Direct Student Loan Program.

It’s important to understand the SAI and how much a student may be expected to pay for a college. Knowing what a student can expect in the form of financial aid can help them avoid excessive student debt and make better financial choices.