- It’s cheaper to save than to borrow:

Regarding college expenses, today’s environment is much more multidimensional than the old maxim of “a dollar saved is a dollar earned”, as many utilize student loans to cover the rising cost of higher education. Having to borrow becomes a much more costly endeavor long term, whereas savings is a more attractive option. For example, saving $100 per month averaging a 4% rate of return compounded annually over 18 years would produce about $31,437.

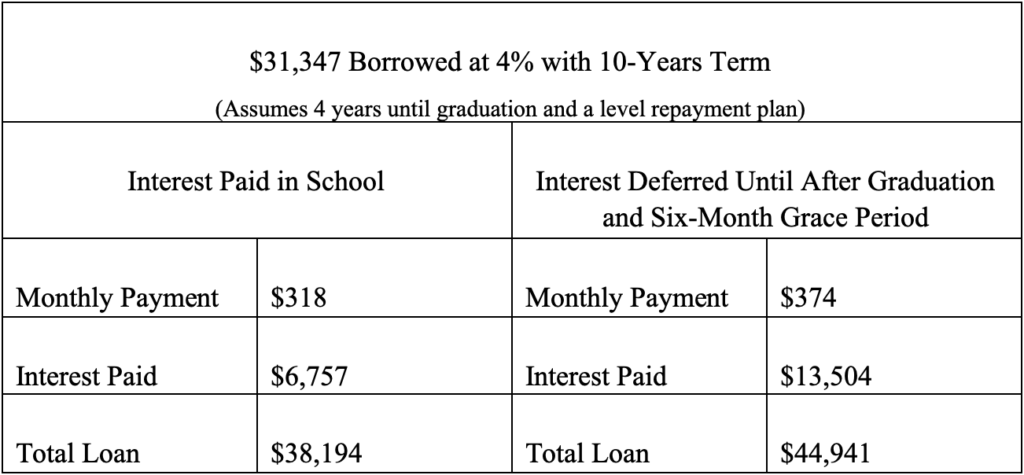

It’s much better to earn interest by saving than to pay interest while borrowing. The following table provides a breakdown displaying the potential financial impact of borrowing $31,347 at 4% under a ten-year repayment plan.

While payments on student loan interest may be a tax deduction in future years of repayment it’s clear that a little bit of early savings goes a long way to cover college expenses and that borrowing can be costly.

- No income limitations:

Regardless of how low or high family income is, there are no income limitations associated with the 529 plan. This is unlike the Roth IRA, a retirement savings program that is only available for single people making less than $144,000 per year or married couples earning less than $214,000 per year as of 2022. People with income levels below $129,000 and $204,000 for these respective filing statuses may make a maximum Roth IRA contribution of $6,000 ($7,000 if you’re 50 or older) and reduced contribution amounts based on income level until the income caps are reached. High-earning investors can make saving a financial priority and are not limited by 529 Plans.

- Tax-free growth:

Quite simply, 529 plans offer a tremendous benefit of tax-free growth. Specifically, all earnings grow free from federal taxes and typically from state taxes as well when withdrawals are used for qualified expenses. State tax treatment may vary. Numerous states offer full or partial tax deductions or credits for contributions to the taxpayer’s in-state 529 plan. A few offer those deductions or credits for contributions to either in-state or out-of-state 529 plans.

- Best savings option when considering financial aid:

Families concerned that their savings may affect their eligibility for need-based financial aid should take a look at the 529. Ultimately, the way cash is saved is what’s most important. On the FAFSA (Free Application for Federal Student Aid) money saved in a 529 plan owned by the parent or by the student is weighed against financial aid eligibility at 5.64% when the student is a dependent student. For example, $10,000 saved in a 529 could end up reducing financial aid eligibility by $564. However, this is much better than having money in a standard savings account in the student’s name, where it can be weighed against financial aid eligibility by 20%. The 529 provides a superior vehicle for college savings given financial aid regulations for higher education.

- Great for estate planning:

Grandparents are finding creative ways to help fund college for their grandkids while retaining control of their assets as part of their estate. Money put into a 529 is removed from the taxable estate, but grandparents can retain rights of control over the 529 account even when funding is typically used to cover future college expenses for their grandchildren. Generally, the goal of estate planning is to reduce tax liabilities and provide assets to family members as efficiently as possible. Currently, there are taxes in place for cash gifts, and any gift amount made by an individual above $16,000 per person could be a taxable event. However, providing funds through a 529 can limit exposure to gift taxes normally involved in estate planning. Talk to your financial advisor to learn more about 529 plans for effective estate planning.

Please note: the calculations in this article are estimates based on several simplifying assumptions. The values may not apply to your specific circumstances, are for a hypothetical savings vehicle or loan, and are for educational purposes only.