Use these holiday hints to increase college savings and by this time next year, you’ll be proud of your accomplishments. (…and don’t forget to clue in grandparents and other relatives to get a bigger bang for your buck!)

Open or add to a College Savings Account – today.

Saving a dollar today is better than borrowing one tomorrow ®. More than 13.7 million 529 Account holders have saved over $361 million 529 College Savings accounts. They are taking advantage of tax-free growth, state tax advantages where applicable and tax-free withdrawals as long as the money is used for qualified education expenses. Congress expanded 529 accounts to permit savings to be used for apprenticeship programs, k-12 expenses and student loans in addition to college costs. Check your program for the tax and other details for your plan. These free tools will help you find a 529 Plan, learn about state tax deductions, calculate how much savings you might need and understand the cost of delaying savings.

Check the couch for loose change – 2020 style

The pandemic has changed many of our spending habits. You may find some proverbial loose change by checking automatic withdrawals and payments connected to your bank account. Take that found money and re-allocate it to a 529 college savings.

Make College Savings a Holiday Present

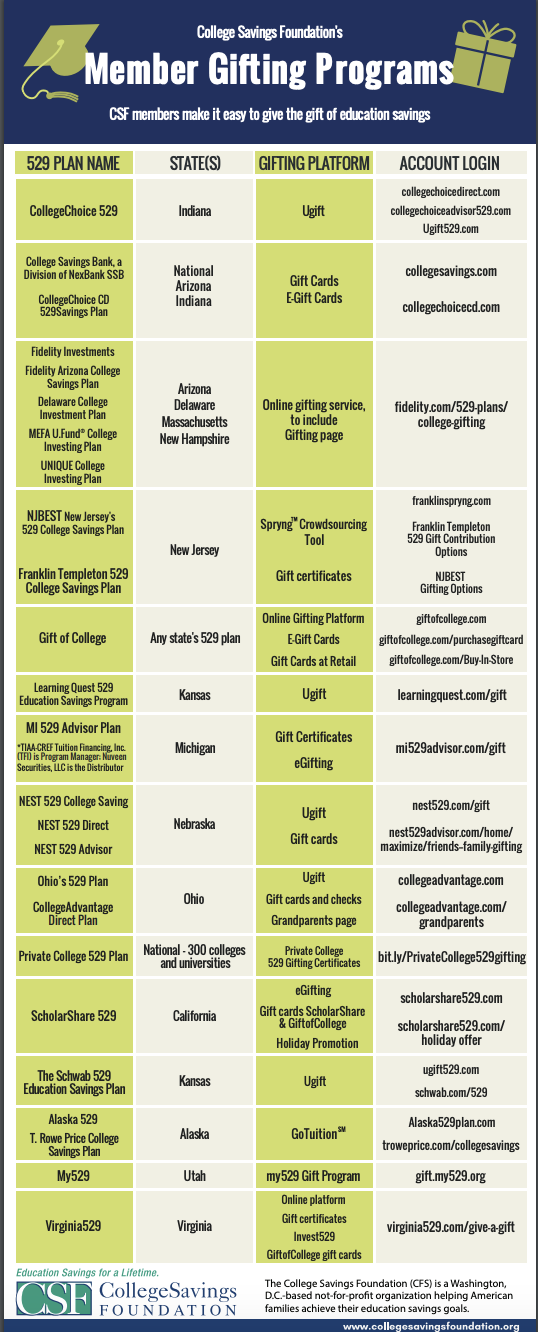

Take advantage of many great new programs that are making it easier to save for college with gift cards. According to the College Savings Foundation many states and some national platforms offer online, and other gifting options make college savings easier. These innovations come in many variations so finding options that work well for your family should be easy:

- Online gifting and/or gift certificates and coupons that can be printed and presented as gifts – with the gifted amount automatically deposited into a 529 account.

- Emailed invitations offering gift-givers access to make a gift directly into a 529 account.

- Customized web pages with family or beneficiary (student) specific information.

Use Credit Card “Cash-Back” Rewards to Fill up 529 Plans

Find a credit card linked directly to 529 Plans or be disciplined about depositing Cash Back Rewards from other cards into a college savings account. The great things about these programs is that they allow you to fill your 529 coffers as you go through your normal day: no behavioral changes are necessary. Just be sure to not roll-up big credit card bills that you can’t pay in full each month to avoid paying big interest that will easily wipe-out the amount you can save.

- Credit Cards linked to College Savings. There are several credit cards that permit users to accumulate cashback rewards to be deposited into the 529 accounts. Some of these programs include:

- CollegeCounts 529 Rewards Visa Card offers 1.529% back for those with a 529 Account offered by Union Bank in Alabama’s 529 Program and the Illinois Bright Horizons.

- Fidelity Rewards Visa Signature Card offers 2% cashback to certain Fidelity accounts including Fidelity managed 529 Plans.

- The Upromise MasterCard offers a range of cash-back benefits depending on the products purchased and the merchant from which they were purchased.

- Other Cash Back Cards. Even if your credit card is not directly linked to a 529 Plan, you could easily take some or all of those cash rewards and deposit them into a 529 Plan. Every bit helps!

Each of these will allow you to increase savings without changing any of your current spending or giving habits. Find one or more that work well for your family. Recruit grandparents, relatives and friends to help and you’ll accumulate a nice nest egg that will no doubt reduce the amount that might need to be borrowed for college later.